Nifty: Bulls Beware

January 24, 2022 2022-01-24 15:49Nifty: Bulls Beware

In this article we will discuss the technical structure of Nifty. First we will analyze things as per classical technical analysis and then we will discuss the squeeze structure.

Classical Technical Analysis View:

From the above daily time frame chart of Nifty Future we can see that price has closed below 20 and 50 EMA and daily RSI has slipped below 40. This clearly suggests that short and medium term trend is down. ADX value is +20 with -DMI being dominant. This structure clearly suggests that the trend is not only down but the possibility of this down trend getting stronger is high. Besides we can clearly see that the recent down move is supported with volumes.

So the overall structure on a daily time frame is sending a loud and clear message “Bulls Beware”.

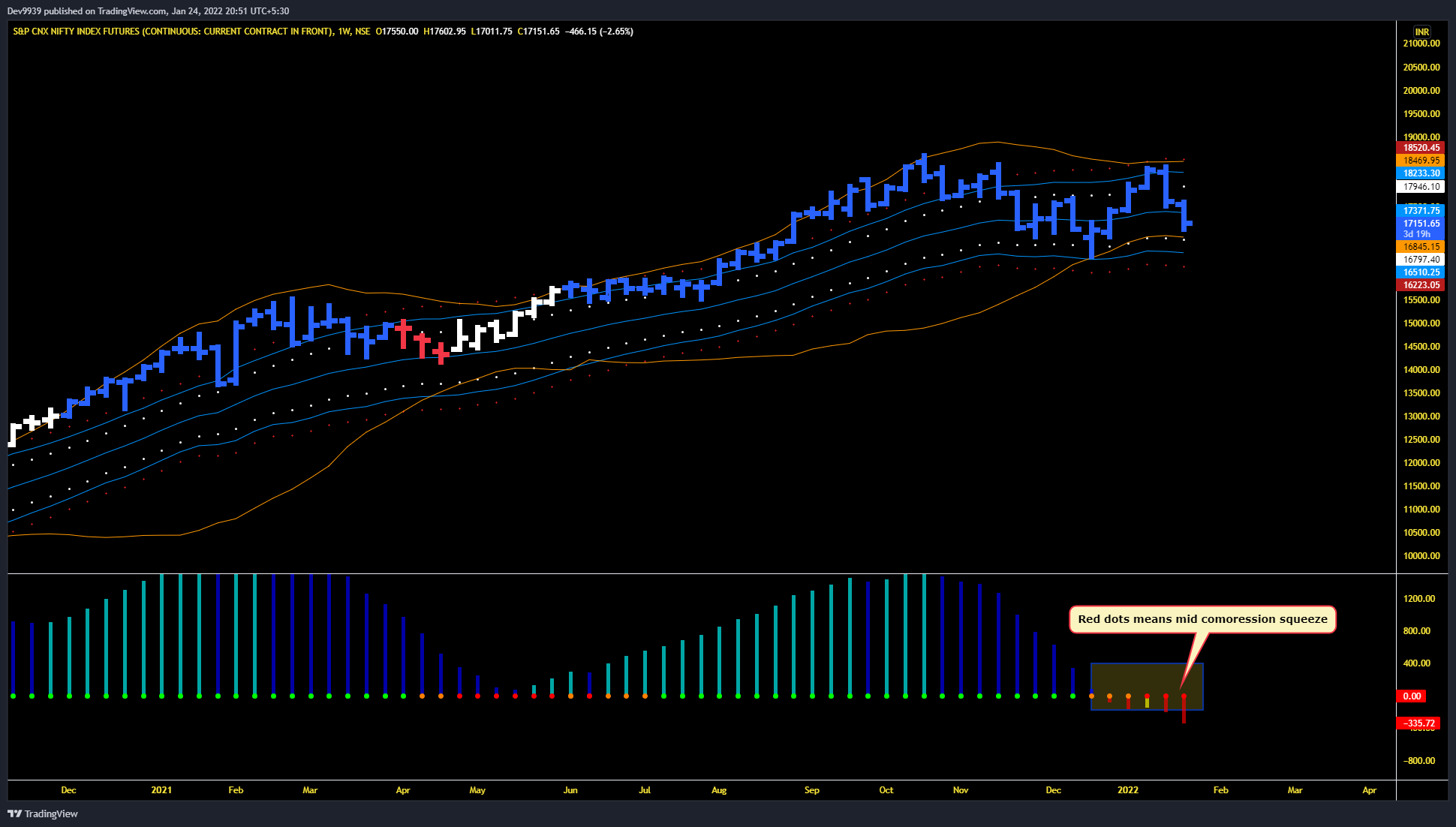

Above is weekly chart of Nifty Future and we can see that it has lost its 20 EMA so far and weekly RSI is below 60. The ADX on a weekly time frame has slowed down and -DMI & +DMI are at kissing point i.e. we might have a positive cross over -DMI and +DMI. This gives us a hint that the weakness from a daily time frame might spread in a weekly time frame. On a weekly 16850-16800 is a crucial support and a close below 16800 on a weekly basis may add fuel to this down side momentum.

Squeeze Structure:

As per weekly we have a mid compression squeeze. (See Below Chart)

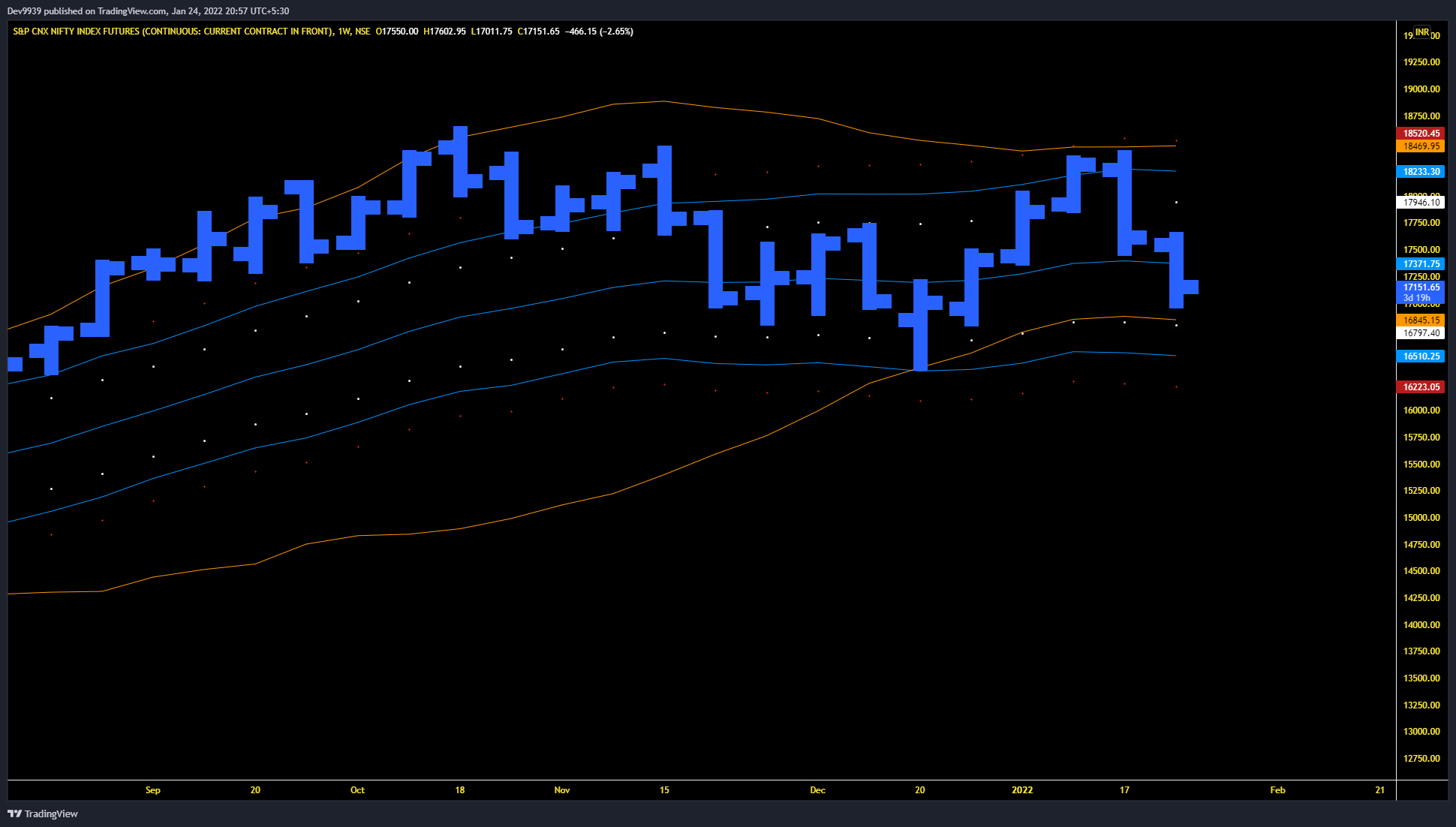

We can see that on a weekly we are below 20 EMA and the momentum is on the downside. So the Squeeze may fire on the downside. On a weekly still we are above -1 ATR (white dots on a chart) move from 20 EMA and -1 ATR from 20 EMA is around 16797. (See Below Chart)

As per traditional technical analysis we analyzed that 16850-16800 is crucial support and as per squeeze also -1 ATR level is around 16800. So 16800 is very crucial weekly level and a weekly close below 16800 may set the weekly squeeze on fire. In that case we may see 16200-16000 levels which is -2 ATR (Red dots) from 20 EMA on a weekly.

Comments (2)

Abhishek gupta

Sir I m following last 2 years u r analysis is remarkable Simple to exceptional level analysis

Team Dev

Thanks